Support the Timberjay by making a donation.

Study: Minnesota’s tax system among the fairest in the U.S.

REGIONAL— A new study that compares the tax structures of the 50 U.S. states has found that Minnesota has the fairest tax structure of all. The report was released this month by the Institute …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, or purchase a new subscription.

If you are a current print subscriber, you can set up a free website account and connect your subscription to it by clicking here.

If you are a digital subscriber with an active, online-only subscription then you already have an account here. Just reset your password if you've not yet logged in to your account on this new site.

Otherwise, click here to view your options for subscribing.

Please log in to continue |

Study: Minnesota’s tax system among the fairest in the U.S.

REGIONAL— A new study that compares the tax structures of the 50 U.S. states has found that Minnesota has the fairest tax structure of all. The report was released this month by the Institute on Taxation and Economic Policy, a non-partisan Washington D.C.-based organization that focuses on tax and economic policies and proposals.

Their latest study, titled “Who Pays?” analyzes the widely varying tax systems in each state and the District of Columbia to determine the progressivity or regressivity of each states’ system. As with most such analyses, the study considers the share of overall state and local taxes paid by various income groups, from the lowest to the highest income households.

Under a progressive tax system, individuals within each income group should pay roughly the same percentage of their income in overall taxes, while regressive tax systems tend to put more of the tax burden on lower income households.

According to the group’s findings, Minnesota has the most progressive tax structure in the country, largely because of its heavy reliance on a progressive income tax for much of its revenue. The study found that the reliance on income taxes helped to compensate for other state taxes which fall most heavily on lower income households. Sales taxes, for example, claim six percent of the income of Minnesotans in the lowest 20 percent of income, compared to just 0.9 percent for the top one percent. Property taxes vary less across income groups, accounting for about two-to-three percent of household incomes across the income spectrum, with those at the bottom and at the very top paying the least in terms of a percentage of their incomes.

Income taxes, by contrast, provide a variety of refundable tax credits for those in the bottom 20 percent that actually supplement their income by an average of about two percent, while the top one percent pay 7.6 percent of their income in state income tax.

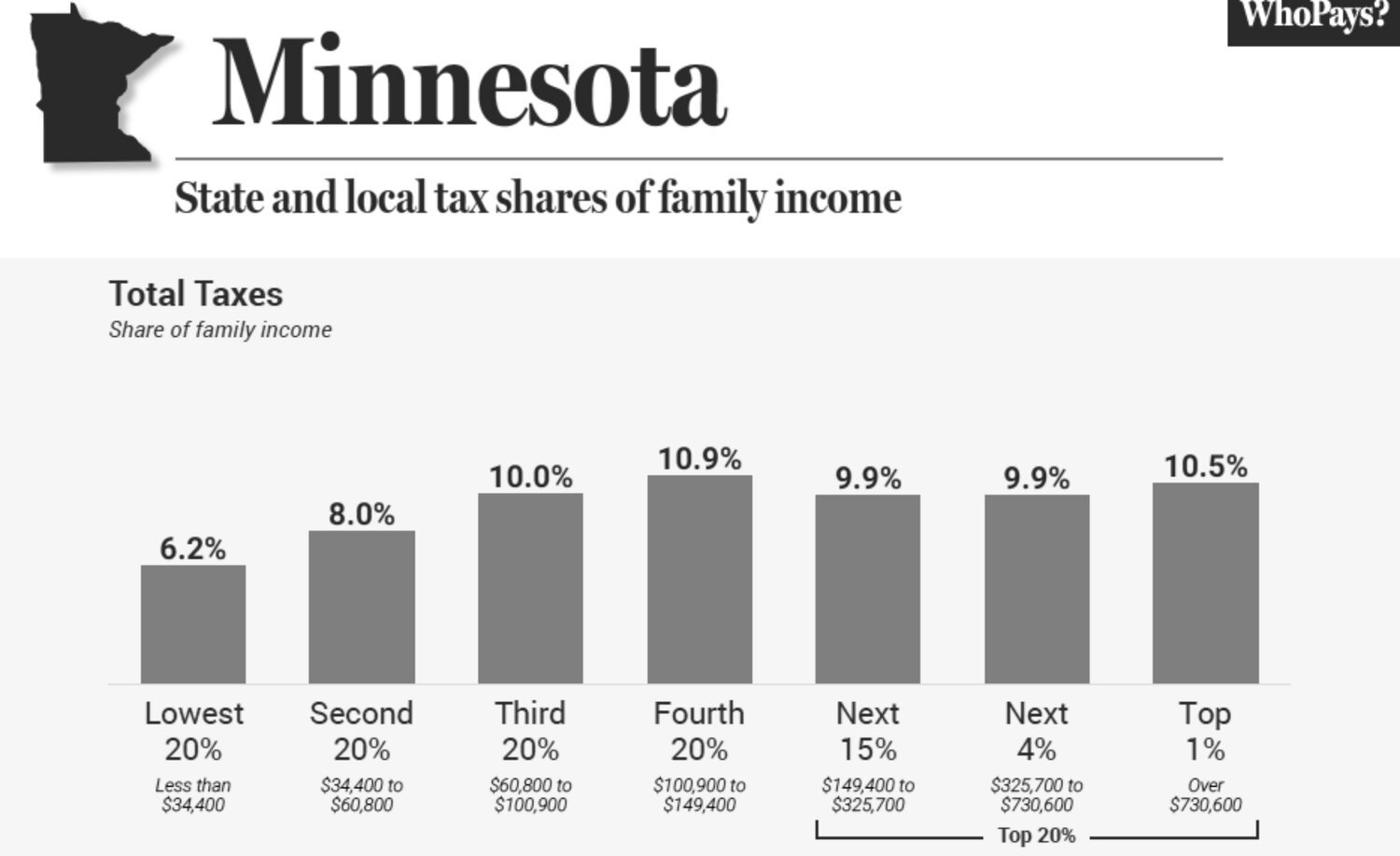

Combine the impacts of those varying taxes and the vast majority of Minnesotans pay between 10-11 percent of their incomes in total state taxes, remarkable parity compared to most other states. Those in the bottom 20 percent now pay the least, at 6.2 percent of their income in total taxes, while those ranked in the 20th-40th percentile pay eight percent of their income in state taxes. The study found that the 60-80th percentile pays the highest overall tax rate at 10.9 percent, while the top one percent pay 10.5 percent (see chart for each income group).

The research team that produced the study noted that Minnesota’s so-called property tax “circuit breaker,” which limits the percentage increase on property taxes, and which includes renters, has also helped keep Minnesota’s taxes fairer. According to the study, other policies that contribute to the fairness of the state’s tax structure include the sales tax exemption for groceries, higher tax rates on high value properties, and the state levying of an estate tax for larger estates.

Minnesota’s remarkable tax parity contrasts sharply with many other states, where the lowest income households tend to pay much more of their income in taxes. In Florida, for example, which has the country’s most regressive tax structure, households in the bottom 20 percent pay 13.2 percent of their incomes in state and local taxes on average, while the top one percent pay just 2.7 percent.

Other states in the Upper Midwest are somewhat fairer in terms of taxation than in places like Florida or Texas, but none has managed the progressivity of Minnesota’s tax structure. Wisconsin, for example, those in the bottom 20 percent pay the highest tax rate of all, at 10.8 percent, and that percentage drops steadily as one moves up the income ladder, falling to 6.6 percent for those in the top one percent. The poorest North Dakotans also pay more of their incomes in state and local taxes than any other income group, at 9.8 percent. That falls to a low of 4.9 percent for the top one percent.

Minnesota stands out for fair taxation

Minnesota’s tax fairness stands out as somewhat unusual among the 50 states, according to the report. “On average, the lowest-income 20 percent of taxpayers face a state and local tax rate nearly 60 percent higher than the top 1 percent of households,” states the report. “Only six states and the District of Columbia now reserve their lowest overall tax rates for low-income families. Those states are Maine, Minnesota, New Jersey, New Mexico, New York, and Vermont.”

While Minnesota is widely considered a high tax state, the study found that such a claim depends on your income bracket. For those in the top one percent, Minnesota does have higher taxes than other states, but it has one of the lowest overall tax rates for families in the bottom 40 percent based on income, which includes households making $60,800 or less annually.

“States such as Florida, Tennessee, and Texas are often described as “low tax” due to their lack of personal income taxes,” notes the report. “While this characterization holds true for high-income families, these states levy some of the nation’s highest tax rates on the poor.”